318

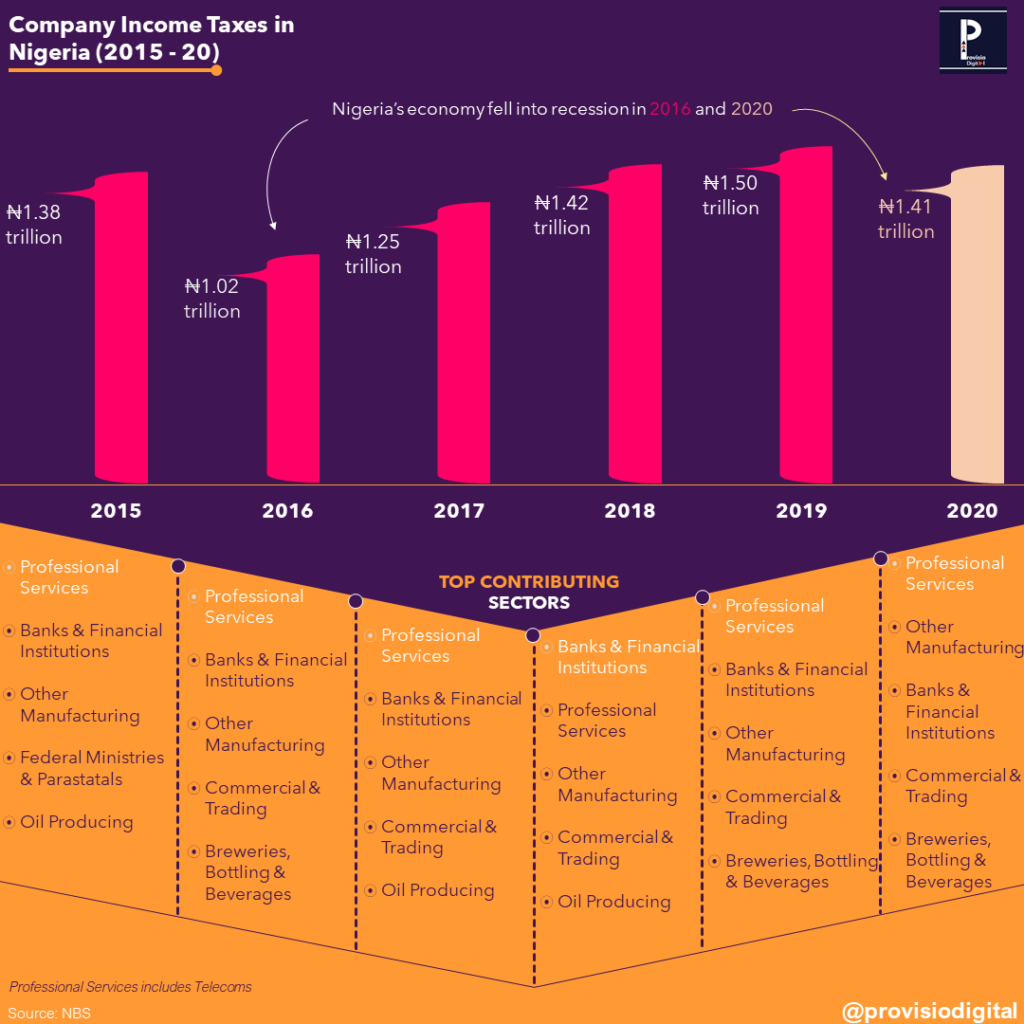

Company Taxes in Nigeria

Why We L👀ked Into This »🎨

|

Company Taxes in Nigeria

- In 2020, Company Income Taxes fell to 2018 levels just after picking up from the 2016 dip.

- Both 2016 and 2020 were years Nigeria’s economy fell into recession.

- Professional Services and Banks & Financial Institutions are the sectors that contribute the highest income taxes. However, in 2020, Other Manufacturing was the second highest. This could be due to the effects of the pandemic where manufacturing of essential items were exempted from lockdown measures. While financial institutions were also essential providers, capacity reduced due to closure of offices to customers.

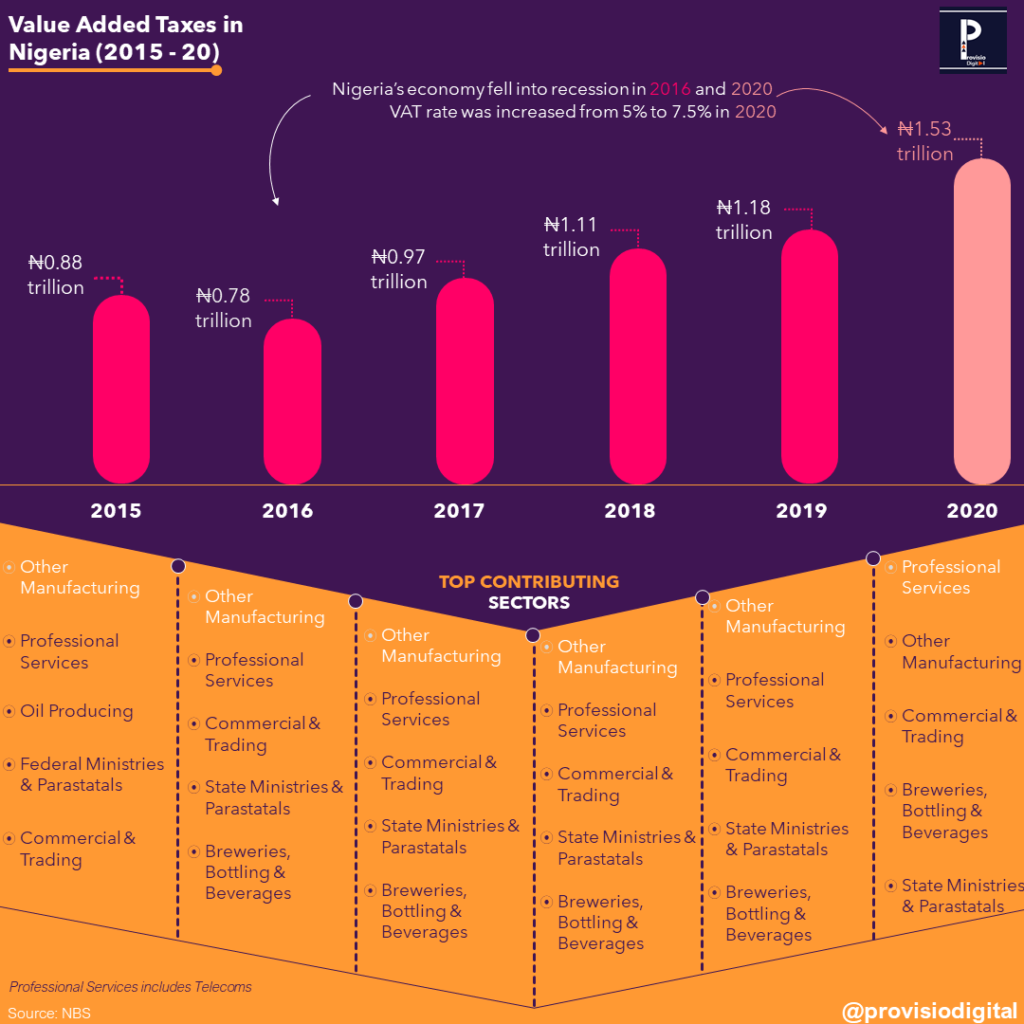

Value Added Taxes in Nigeria

- Value Added Taxes (VAT) are indirect taxes paid by consumers through sales of goods and services. The Nigerian Government increased VAT rate from 5%to 7.5% in 2020.

- In 2020, VAT reached an all-time high of 1.53 trillion naira.

- Both 2016 and 2020 were years Nigeria’s economy fell into recession.

- Other manufacturing and Professional Services are the sectors that contribute the highest VAT. Professional services include Telecommunications.

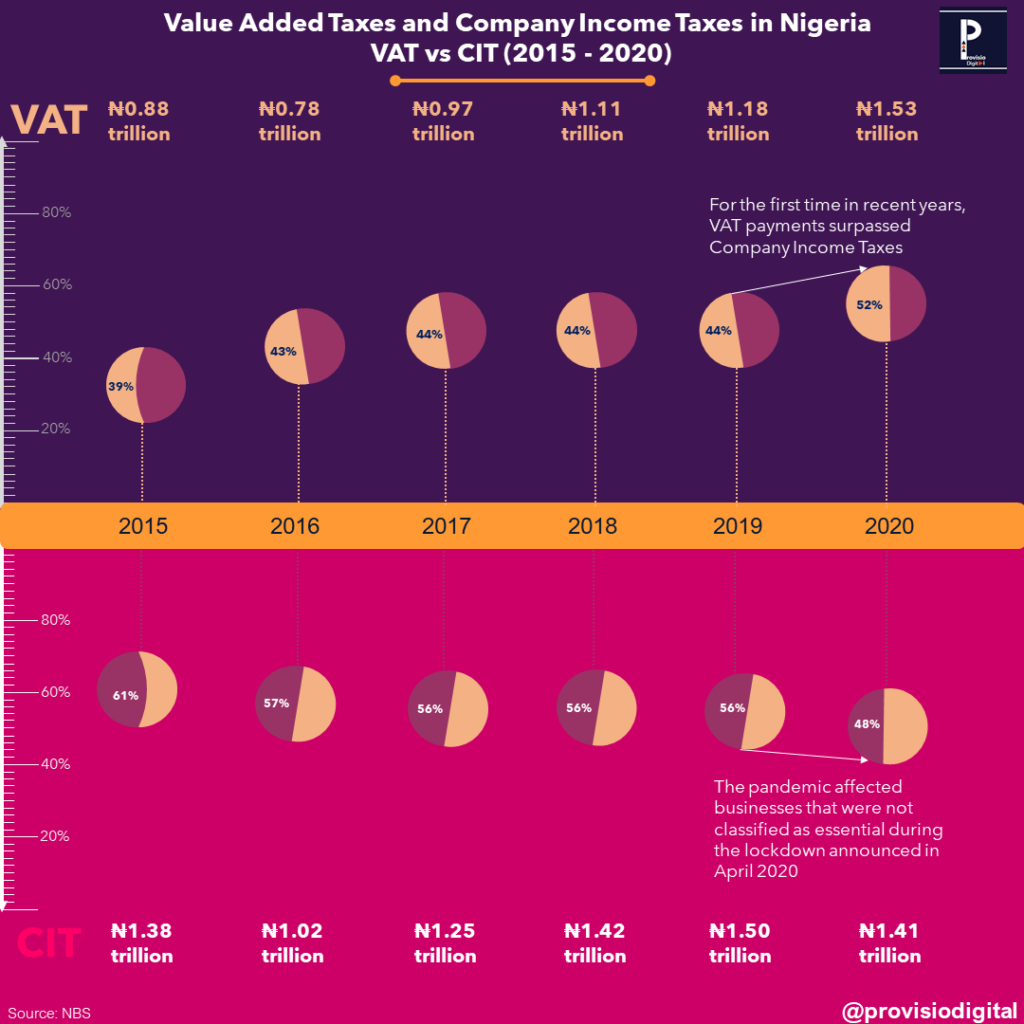

Corporate Income Taxes vs Value Added Taxes in Nigeria

- In 2020, VAT contributions surpassed CIT for the first time in recent years.